Economic inequality has persisted throughout American history but need not be accepted as the norm. The economic fallout of the pandemic has been far from equal across gender, income level, and race/ethnicity. High unemployment, income disparities, wealth gaps, and other demographic factors have left women particularly vulnerable during this economic downturn, but this is not the first time we are observing this.

Over a decade after the Great Recession, the devastating economic downturn and its long-term effects still loom in the minds of many. Fundamental differences exist between the pandemic recession and the Great Recession, one being the widespread shutdown of schools and businesses during the pandemic. Despite these differences, one thing remains the same: young, lower-income, less-educated, and Black workers are facing some of the harshest effects during the recession and recovery.

This parallel represents a missed opportunity to learn from the unequal fallout of the Great Recession. To understand how different segments of the population experienced financial security during the pandemic, household-level data on labor market shocks offer insight.

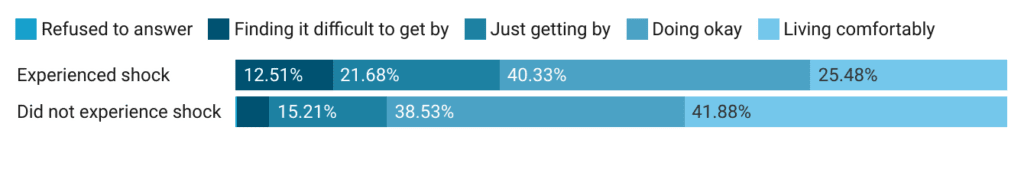

Labor market shocks include the following: losing a job, reduced work hours or unpaid leave, and applying for unemployment insurance. Figure 1, below, presents adult (ages 18–93) women’s self-reported financial wellbeing in July 2020 by whether they experienced a labor market shock. Predictably, financial insecurity (answering “finding it difficult to get by” or “just getting by”) is more common among women who experienced shocks: 34.19% of those who experienced shocks are financially insecure, whereas only 19.41% of those who did not experience shocks report the same.

Figure 1. Financial Wellbeing of Women

After controlling for demographic variables, women who experienced labor market shocks are 9.22 percentage points more likely to report financial insecurity than women who did not experience a shock. Alongside labor market shocks, many determinants of financial insecurity can be tied back to individuals lacking a safety net to fall back on during economic downturns.

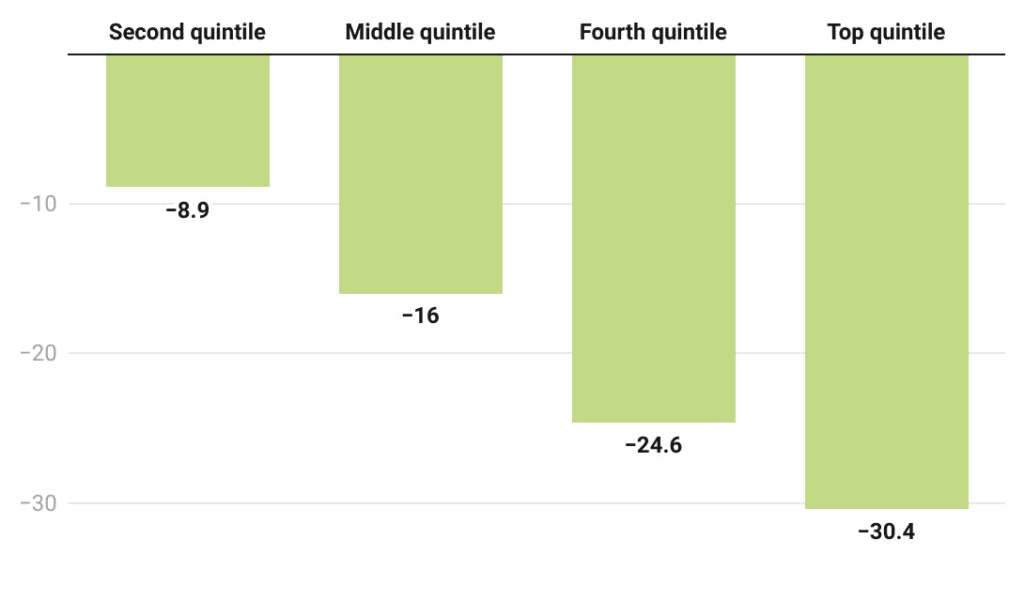

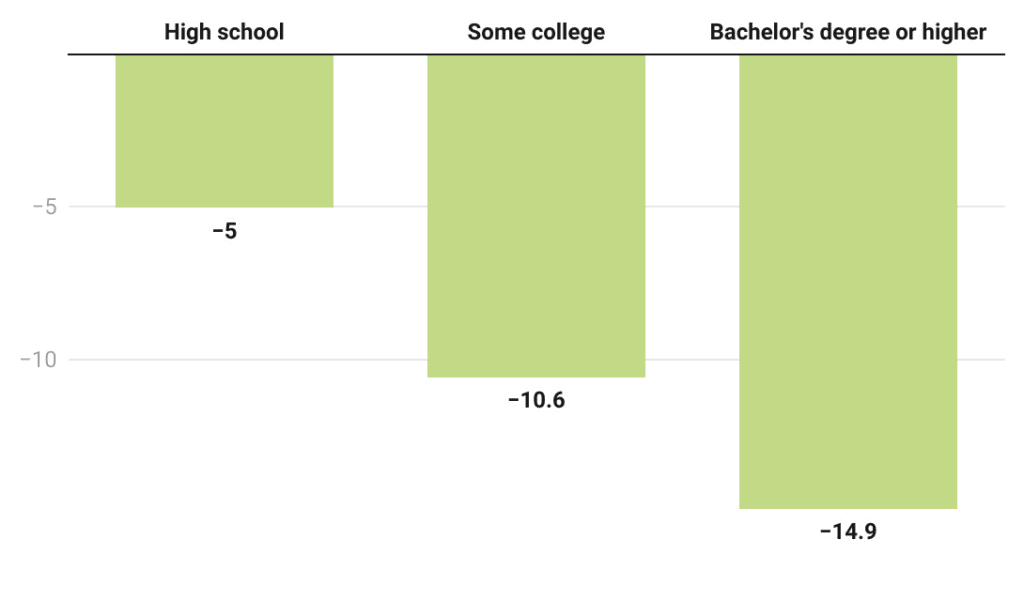

Figures 2 and 3 show that women who are in higher income quintiles and more educated are less likely to report financial insecurity.

Figure 2. Impact of Income on Financial Insecurity

Figure 3. Impact of Education on Financial Insecurity

Older women demonstrate a similar trend: each additional year of age is associated with a 0.192 percentage point decrease in the probability of reporting financial insecurity. Having worked fewer years and making less money can inhibit women’s ability to save money, placing them in a vulnerable position if they experience a temporary setback, like the loss of a job.

Relative to White women, Black women are 6.27 percentage points more likely to report financial insecurity. A possible explanation for this is the Black-White wealth gap. Going into the pandemic, the average White household had eight times the wealth of the average Black household. Black women are vulnerable not only along this racial dimension, but also along a gender dimension, as they hold less wealth than their male counterparts, irrespective of race. Wealth is an important resource to tap into during economic downturns, but on average, Black women have less wealth at their disposal.

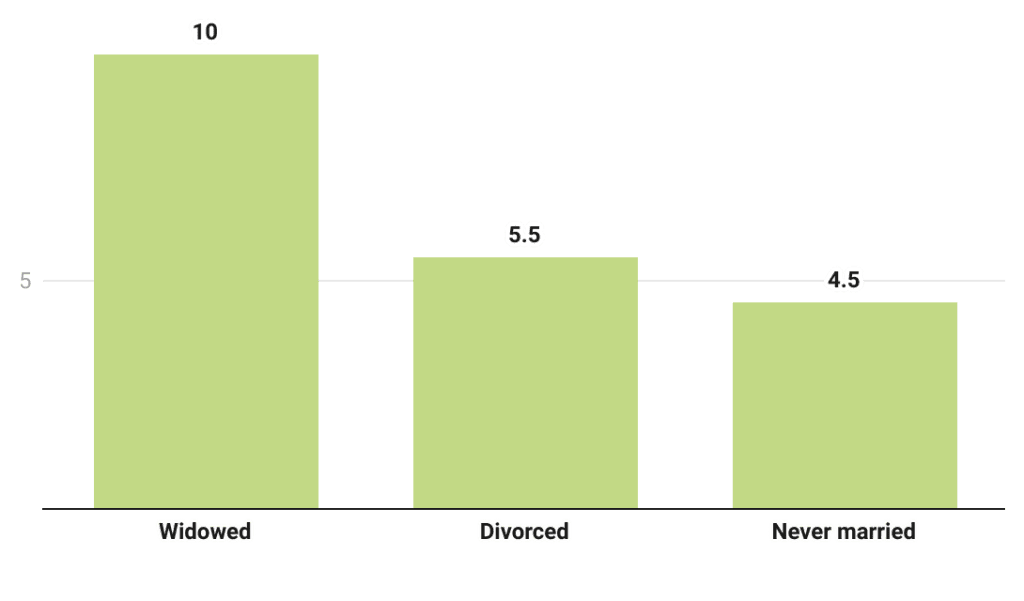

As shown in Figure 4, widowed, divorced, and never-married women are more likely to be financially insecure than married women. Families maintained by women are less likely than families maintained by men and married-couple families to have an employed member, so the lack of an additional source of income can place stress on their finances during already difficult times.

Figure 4. Impact of Marital Status on Financial Insecurity

Additionally, the widespread closure of schools and daycares has forced mothers to make tough decisions about work and caregiving responsibilities, reducing their labor force participation rates. Without a spouse or cohabitation partner, even more of child care and domestic responsibilities fall on these women’s shoulders.

Considering the many disparities that COVID-19 has worsened, returning to pre-pandemic labor market conditions will be a long journey. Still, the effort cannot stop there. Economic recovery needs to do more than bring us back to pre-pandemic inequalities—it must also close the long-standing inequalities in unemployment, income, and wealth. Since financial insecurity has been especially pronounced for women who are young, lower-income, less-educated, and Black, policymakers must account for disparities across these demographics. Targeted support that helps vulnerable groups of women return to long-term employment and a state of financial security is necessary for an inclusive recovery.

Zaria Roller is a summer fellow in the American Economic Association Summer Training Program at Howard University, and the Women’s Institute for Science, Equity and Race is her experiential learning host. She is a junior studying economics at Williams College.